As you’re refining product development, marketing and distribution strategies for home improvement materials in the coming years, you need to evaluate what’s currently happening in the industry and where opportunities and challenges exist.

Tougher competition, economic uncertainty, rising materials costs, and confidence among homeowners and professionals are just some of the factors impacting the size of the home improvement market and spending trends that we can expect to see in 2025 and beyond, curated in our recent Industry Drivers and Forecast report.

Key Economic and Market Trends Influencing Home Improvement Spending in 2025

Here is a look at key insights impacting the size of the home improvement market:

1. Labor Supply May Constrain Our Industry

Labor participation—which measures how many able adults are involved in the workforce—declined heavily during the COVID-19 pandemic, according to data from the U.S. Bureau of Labor Statistics. We saw some recovery in the following years, with participation now seemingly stabilized, albeit below the necessary level. For the home improvement industry, the construction unemployment rate continues to see seasonal trends and at times is lower than the National Unemployment rate signaling a tight construction labor market. The most recent unemployment data doesn’t account for the federal layoffs and funding freezes, which could affect both the overall unemployment rate, as well as regional and state economies, considering that federal agencies often contract with local providers for services.

However, after several years of increasing job openings, there were 217,000 open construction jobs in December 2024 —a 50% decrease from December 2023, and the lowest number of job openings since April 2020. This decline in job openings may be due to lower homeowner demand, seasonal impacts, or other factors reducing the need for labor compared to the longer trend that had been building for over a decade. It may be several months before we can fully identify the potential ramifications for the home improvement industry, particularly on a commercial level.

.jpg)

2. Prices for Materials Remain High, with an Uncertain Future

The cost of construction materials can significantly impact the industry, both in terms of spending and project costs. Data from the Producer Price Index (PPI), put out by the Federal Reserve Economic Data (FRED), shows that costs have stabilized in many areas through 2024.

This continues to be a top concern for contractors, along with the general state of the economy, according to the Quarterly Contractor Activity Tracker for Q4-2024. More than half of professional contractors, builders, and remodelers cited concerns about the price of materials at the end of last year, and they see it as a challenge to future business growth. Meanwhile, events that have occurred in the political sphere during the first quarter of 2025 have instigated additional social and economic uncertainty at both an industry and consumer level. The threats of and implementation of trade tariffs by the U.S. government, and the responding actions of trade partners, has created more uncertainty for building product manufacturers, suppliers, and customers. While we expect this situation to have an impact on the cost of raw materials, including steel, aluminum and softwood lumber, long-term effects remain to be understood. Product brands and suppliers should brace themselves for some degree of volatility and strategic planning for both worst- and best-case scenarios.

3. New Homes are Highly Competitive Against Low Inventory of Existing Homes for Sale

Single-family permits, starts, and completions are following an upward trend in recent years, but growth in starts is slow because of increased costs, increased interest rates, limited capacity for homebuilders, and recent increases in new home inventory that must first be cleared out.

Home builders are working to reduce inventory by offering rate buy-downs and discounts. As a result, the prices of new homes are now comparable to, and in some cases lower than, those of existing homes—an unusual situation that boosts demand for new construction. Meanwhile, with limited inventory of existing homes, prices remain elevated. Additionally, the low number of new housing starts means that existing homes will continue to age, leading to increased demand for repairs and renovations as materials and products deteriorate.

Considering the fact that the housing stock is aging—the median age of owner-occupied homes was 43 years in 2023, compared to 31 years in 2005—we can remain optimistic in the demand for repair and maintenance improvements in the coming years. In terms of existing inventory, national home values remain strong, which drives home equity, indicating significant financial leverage for existing homeowners. This purchasing power often translates into renovating or upgrading homes.

4. Lock-in Effect Remains

Demand for housing is high but has leveled over the past two years. Because of higher interest rates, high home values, and high material prices, we’ve witnessed a “lock-in effect” within the housing market. Homeowners are hesitant to move until conditions improve and they can see the value in moving. As of the end of the second quarter of 2024, 56% of homeowners with mortgages had interest rates below 4% (down from 60% one year ago and 65% in 2022); 22% have a mortgage below 3%. With rates and home values holding strong, many homeowners have incentive to stay put. However, an estimated 39% of homeowners are without a mortgage, which is an all-time high, and that factor—combined with high home equity—represents a more mobile segment. This group may represent opportunities for mobility. However, the Housing Affordability Index (HAI) for the collective is near its lowest point in more than 20 years. Expect the trend of decreasing mobility to continue so long as inventory is low, home prices remain high, and mortgage rates hover around 7%. This makes the case for increased optimism of home improvement activity.

5. Consumer Confidence Trending Down

Data showed that homeowner confidence was slowly improving at the end of 2024, but has retreated in recent months causing an increased sense of uncertainty and some pessimism. History tells us that increased Consumer uncertainty, which is often reflected in Consumer Confidence, delays increased consumer spending on home improvement and larger discretionary projects.According to the University of Michigan’s Consumer Sentiment Index, which details consumer attitudes and buying intentions, consumer confidence has dropped each month this year. The Conference Board measures have also seen steep declines each month this year, with certain measures often signaling recession. We may see uncertainty and pessimism in the year ahead, which puts pressure on industry stakeholders to meet growth goals.

Existing home contractors however are more optimistic, though reporting more competition than prior years. We may also be seeing a softening in lead volume, which might impact pro confidence further into the year. At the end of 2024, remodelers, mechanical contractors, finish contractors, and landscape contractors—are reporting steady confidence and a healthy backlog of projects for the near-term. There also were signs of shifting demand towards larger projects, according to data from our latest Quarterly Contractor Index, which may be subsequent increases in material inputs and labor costs. However, the NationalAssociation of Home Builders also tracks confidence and activity among homebuilders across the nation; which, being highly related to interest rates, has been volatile and trending down. In general, homeowner challenges and confidence will impact pro behaviors as they respond to the needs of their homeowner customers.

6. Remodeling Projected to Make Modest Gains in 2025

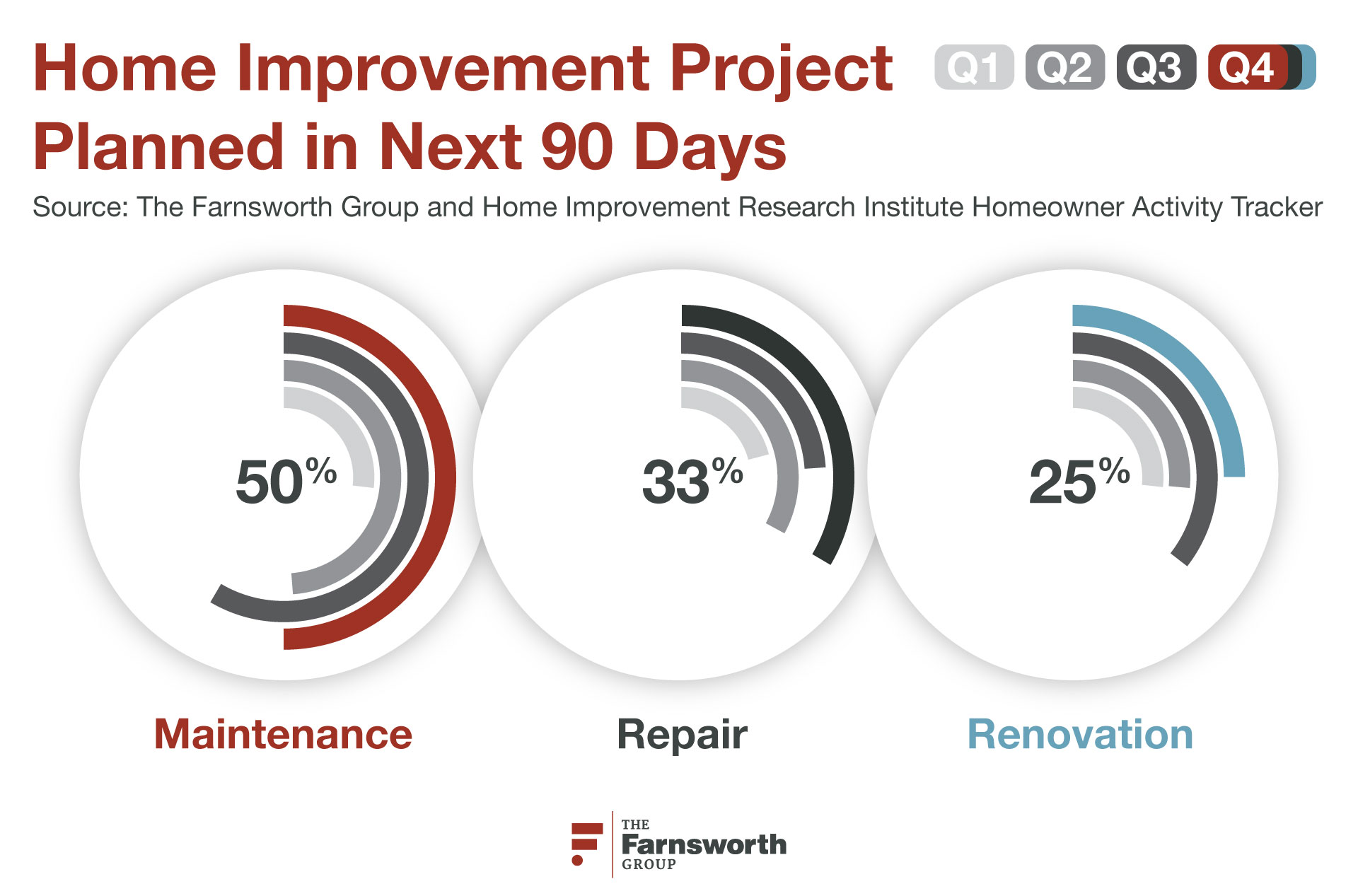

Historically, remodeling tends to be less volatile than new home construction, and we anticipate this trend to continue. According to data from the Joint Center for Housing Studies (JCHS), the remodeling industry is projected to perform better than new housing. Annual expenditures for improvements and maintenance to owner-occupied homes are expected to grow at a mild pace throughout 2025. Our research corroborates this trend. Our Quarterly Homeowner Activity Tracker for Q4-2024 shows that 72% of homeowners have planned projects over the next three months, with renovation intentions showing a modest rise compared to Q3.

Home maintenance remains the top priority, with half of homeowners expected to complete activities in this area. DIY project completions also held steady through Q4, with almost three-fourths of homeowners citing cost-savings as the reason for DIY. If the current concerns over the economy, inflation, and personal finances hold steady, we can expect to see a healthy amount of DIY home renovations and maintenance as homeowners look for ways to save.

7. Consumer Spending Likely Moderating in 2025 But Still Projected to Grow Through 2028

Data from the Home Improvement Research Institute's (HIRI's) short-term forecast anticipates a modest increase in consumer product spend in Q1 and Q2 of 2025 with declines forecasted for Q3 and Q4 of 2025.

Longer term, with slow but steady growth over the next couple of years, HIRI projects that the total spend for home improvement products by consumers will pick back up in 2026 and reach approximately $449 billion by 2028.

For professional contractors and remodelers, the forecast shows an even more substantial uptick in revenue from 2025 onwards, with an estimate of $228 billion by 2028.

Even still, industry stakeholders must be prepared for a certain level of uncertainty. Budget-sensitive homeowners are making tradeoffs when it comes to where and how they spend. Contractors, suppliers, and manufacturing brands must respond accordingly by offering a breadth of prices and value propositions to accommodate a range of needs. Homeowners must feel comfortable and confident about decisions and that what they’re investing into home improvement is worth it.

8. Retailers are Reporting Steady Sales

Revenue for home improvement retailers has grown at a compound annual growth rate (CAGR) of 5.4 % over the past five years, to reach an estimated $297.6 billion in 2024. Home Depot and Lowes dominate the market, raking in upward of $143.6 million and $84.6 million, respectively, in 2024, according to data from IBIS World. Overall, independent retailers are reporting marginal year-over-year sales growth, according to our Independent Retailer Index of Q4 2024.

Approximately 30% saw YoY sales growth in the fourth quarter, which is 7% higher than the previous year’s performance, but significantly lower than the 53% from two years prior. Transaction counts also increased for roughly one-fourth of retailers over the course of 2024 and more retailers saw an increase in profit margins in Q4 2024 over both Q4 2023 and Q4 2022. Looking ahead, about one-third of retailers expect their sales revenue to be higher in the first quarter of 2025, but about 45% also expect the cost of goods to be somewhat or much higher. They plan to make the biggest investments in inventory, followed by staff and employees.

Conducting Custom Market Size Research to Inform Business Strategies

While general insights in the home improvement market are helpful, it’s important to have specific data in order to define opportunities for acquisition, distribution or revenue and strategize accordingly. The Farnsworth Group provides customized market research specifically within the home improvement, building products, and lawn and garden industries. Utilize this direct feedback from end-users and suppliers to give you the detail you need.